What Do Real Estate Experts See on the Horizon for the Second Half of 2021?

July 1, 2021

July 1, 2021

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

“While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021….”

“Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.”

“We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.”

“As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.”

“A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.”

If you’re trying to sell your house, you may be looking at this spring season as the sweet spot.

Selling your home in the vibrant Central Kentucky real estate market requires a blend of savvy strategies.

The Central Kentucky real estate landscape in 2024 presents a unique set of challenges and opportunities.

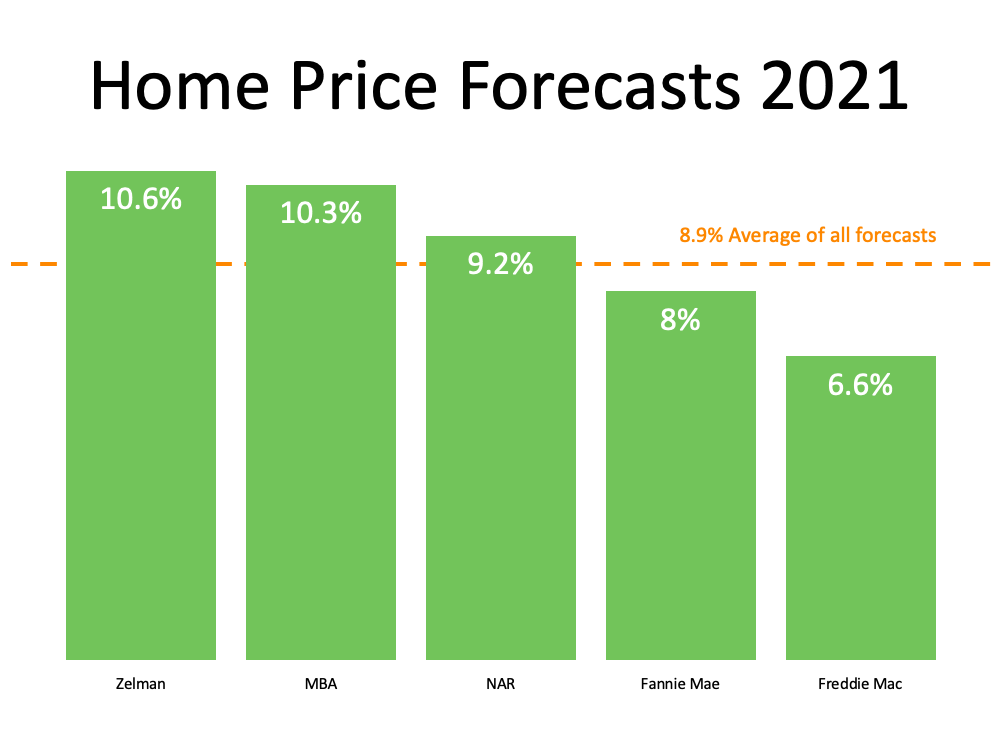

Many analysts projected home price appreciation would slow dramatically in the fall of 2021.

Home prices, mortgage rates, and wages. Let’s look closely at each of these components.

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners.

The question of whether the real estate market is a bubble ready to pop seems to be dominating a lot of conversations.

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers.

Building financial wealth and stability remains one of the top reasons Americans choose to own a home.

Every move is unique, and success is measured by both the experience and the outcome. In partnership with Bradford, every detail will be handled with persistence, discretion, and care.